Telehealth: Evolving a Short-term Response to Long-term Capabilities

As seen in Crain's New York Business

Telehealth is not a new concept for the healthcare industry; before the onset of the COVID-19 Public Health Emergency, however, the provision of telehealth services by health care providers was highly inconsistent with dramatic differences in use across care settings, specialties, and markets.

For many providers, telehealth simply was not a high priority. Patients continued to prefer in-person visits, the technology was clunky because of a lack of integration with workflows, and reimbursement was typically lower for telehealth visits.

Outside of some large health systems that had invested heavily in telehealth and larger digital health capabilities in recent years, health care provider organizations seemed to fall largely into two camps. In the first camp, they were traditional healthcare service providers that were either completely dedicated to in-person visits or intermittently using basic telehealth services. In the second camp, they were internet-based health care service providers that primarily relied on technology to provide on-demand services to patients, similar to a private pay concierge model, and they were building on the overall trend of consumerism in health care.

But the PHE changed telehealth from a “nice-to-have” capability to a strategic imperative, enabling healthcare organizations to provide vital services to patients in a safe and effective way while recouping some of the volume losses that threatened the solvency of parts of the industry. Capitalizing on relaxed regulatory guidance intended to remove barriers to entry, providers went to market quickly with a variety of telehealth solutions and largely made them work.

Based on Medicare data, the use of telehealth services increased from less than 1% of all primary care visits in February, before the PHE, to 43.5% of primary care visits in April. The Centers for Medicare and Medicaid Services said in a recent briefing that it expects the Medicare volume to stay around 21% long term, and other trending data appears to support this transition. The same CMS report highlights the predictable variation in telehealth use across specialties, with psychiatry leading the trends (approximately 60% of visits conducted via telehealth for the measurement period), followed by gastroenterology (49%) and neurology (41%)[1].

Unclear Future for Telehealth Reimbursement

There is a well-cited quote from Seema Verma, the CMS administrator, noting that telehealth is here to stay. "I think the genie's out of the bottle on this one," Verma said. "I think it's fair to say that the advent of telehealth has been just completely accelerated, that it’s taken this crisis to push us to a new frontier, but there's absolutely no going back.[2]"

It is less clear, however, if this will translate to long-term regulation relaxations and continued parity of reimbursement or if, as some are suggesting, CMS will interpret this as a lower cost care model and provide reimbursement commensurate with this perception.

In a Health Affairs blog post from July 15, Verma noted that the CMS is analyzing the relaxed regulations put in place during the PHE to determine which, if any, will be adopted permanently by Medicare post-pandemic. CMS is considering a number of key factors, including the clinical appropriateness of providing services via telehealth, the appropriate reimbursement approach, and how to best protect against fraud and abuse.[3]

Telehealth was a specific agenda item at the Sept. 3-4 meeting of the Medicare Payment Advisory Commission. During the discussion, leaders specifically noted the recent fraud cases by several telehealth companies and mentioned the seemingly mixed results of telehealth services from a quality-of-care perspective. This dovetailed into a recommendation to limit some of the telehealth expansions to clinicians participating in Advanced Payment Models rather than to all fee-for-service clinicians. Such limitations would include the continued expansion of the types of telehealth services that would be covered, the continued ability to provide telehealth services to patients outside of rural areas, and the continued ability for patients to receive telehealth services at home. The discussion noted a recommendation to discontinue the increased rates for telehealth, compared to rates before the public health emergency, for both groups of clinicians[4].

It is even less clear how private payors will handle reimbursement for telehealth services for the long term, but it is a prudent approach for providers to assume at least some of the regulatory flexibilities will disappear and that reimbursement rates likely will decrease, perhaps not to the pre-COVID-19 levels, but at least to some degree. This translates to a specific need for health care organizations to consider how to advance their telehealth strategies to become an integrated part of their organization in a way that is not dependent on relaxed regulations in the future and that still drives profitability for their practice despite anticipated lower reimbursement.

Advancing Telehealth Capabilities

Telehealth can be viewed as a continuum, with a low barrier to entry under current conditions and the opportunity to evolve capabilities over time. Many healthcare providers are beginning to grapple with how to provide telehealth services in their practice in a way that moves beyond a reactive solution to an integrated part of their business strategy.

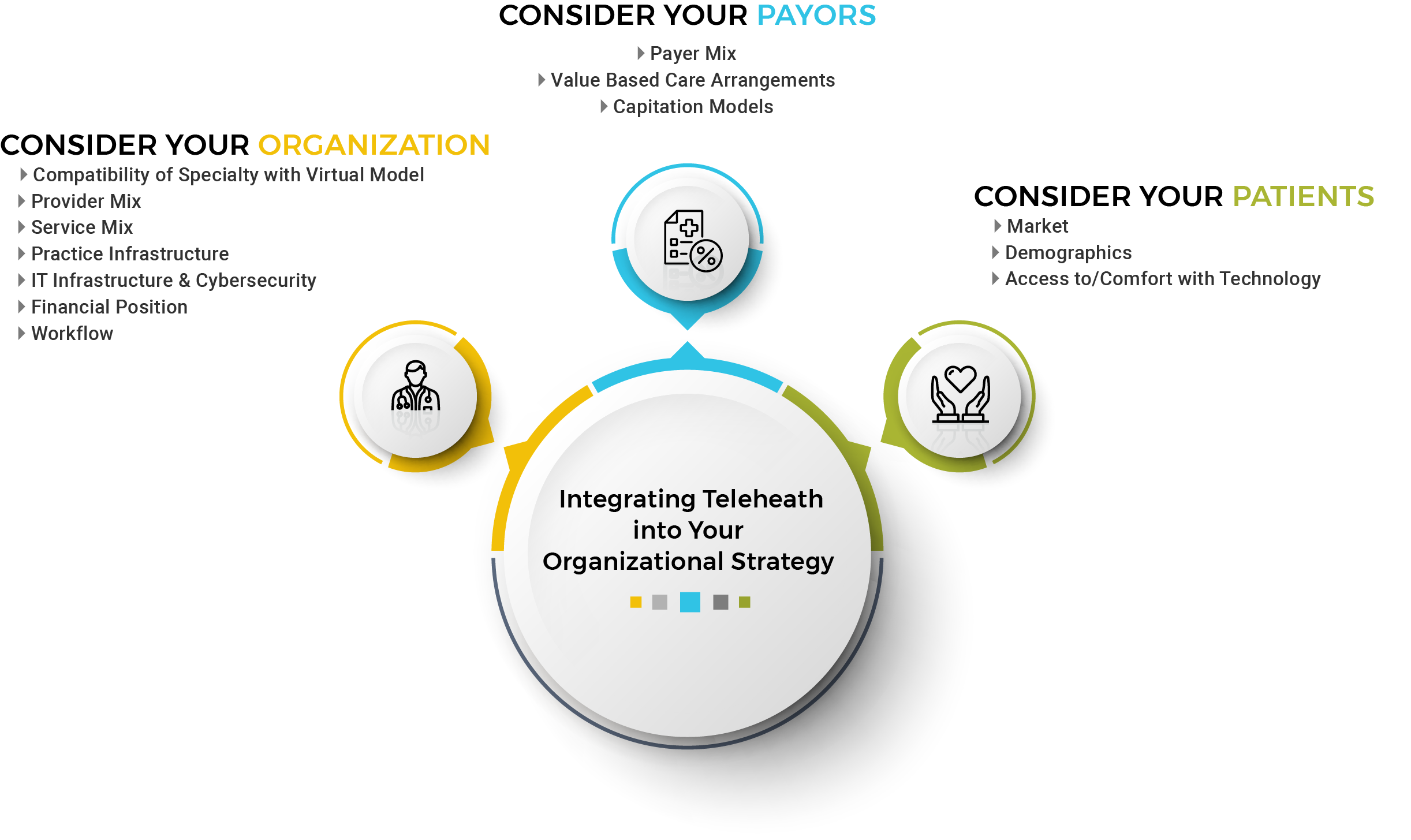

As organizations are considering what telehealth looks like for them, and designing their own telehealth approach, it is helpful to start by really considering their organization, the population they serve and their payors. To develop an efficient and profitable telehealth approach, organizations must understand every potential operational and financial impact on the organization and how further incorporating telehealth services may fundamentally change parts of their operations and even their business model.

Building and deploying a successful and sustainable telehealth strategy will require organizations to explore current performance and begin to define goals for go-forward performance. As a starting point, it is helpful for organizations to consider several key questions:

- Can the organization make telehealth services profitable? What will reimbursement look like over time? Does the organization have the internal capabilities to model reimbursement scenarios to help inform how it will contribute to the overall financial position of the practice?

- How should the organization evolve operations to better align with providing telehealth, including staffing, scheduling and patient communications? How should the organization reevaluate the expense structure, based on how significantly it will provide telehealth services?

- What policies and procedures should the organization either reevaluate or redesign or both to ensure compliance with telehealth requirements?

- Does the organization have the right technology solution? Is the solution adequately protected from a cybersecurity perspective?

Starting with these questions can help orient an organization to the primary areas of focus for building the necessary core competencies and defining a scalable, long-term telehealth strategy.

[1] https://aspe.hhs.gov/system/files/pdf/263866/HP_IssueBrief_MedicareTelehealth_final7.29.20.pdf

[3] https://www.healthaffairs.org/do/10.1377/hblog20200715.454789/full/

Related Insights

All InsightsOur specialists are here to help.

Get in touch with a specialist in your industry today.