How Citrin Cooperman Can Help

Related Practices

How Mature is Your Finance and Accounting Function?

The Complete Guide to Outsourcing Finance and Accounting

Middle market companies require enhanced decision-support capabilities to drive growth. However, finding and retaining the necessary talent to advance finance and accounting functions is becoming increasingly difficult, pushing many companies into a constant state of reaction.

Download our eBooks today to learn more about outsourcing your company's finance and accounting functions:

The Guide to Outsourcing Finance: How Marketing Agencies Can Take Control of Their Finance Function

Access the GuideThe Guide to Outsourcing Finance: How Law Firms Can Take Control of Their Finance Function

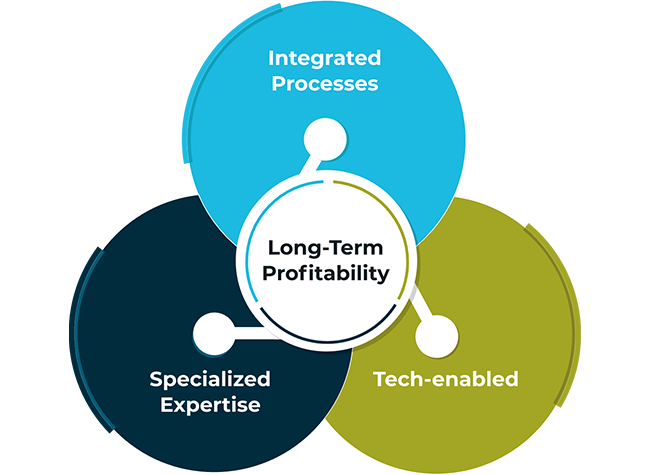

Access the GuideDrive Long-Term Profitability with Highly Specialized Professionals On Demand

Our team of finance specialists evaluates the quality and effectiveness of your procedures, systems, and financial reporting, and how well supported the business feels by your finance department.

WHAT YOU GET

-List of gaps and recommendations for improvement

-Technology recommendations

-Roadmap for implementation

-Continued engagement from assessment leader

During this phase, our team builds on what we learned during the assessment to help your organization develop an efficient and sustainable month-end close process. This also establishes how we will work together moving forward.

WHAT YOU GET

-Month-end close checklist

-Establishment and documentation of standard procedures

-Agreed upon financial reporting and key performance indicators (KPIs)

Using our established monthly cadence, our advisors work alongside your team to efficiently complete regular tasks. At the same time, we make incremental improvements to your processes and financial information.

WHAT YOU GET

-Centralized activities

-Integrated policies and procedures

-Confident and well-deployed staff

During this phase, we set you up for long-term profitability by recommending, implementing, and customizing tools that make monitoring budgets, forecasting, financial projections, and reporting on KPIs easier.

WHAT YOU GET

-Efficient, automated processes

-Relevant, real-time data

-A forward-thinking, highly analytical, and technology-centric finance department

Solving Middle Market Companies' Finance Dilemma

Strategic finance and accounting outsourcing allows you to bring in specialized professionals as needed, build better processes and reporting, and select and integrate the right technology – in a model that easily scales up and down as you need it.

Solving Middle Market Companies' Finance Dilemma

More Than Just Bookkeeping

A Media Agency Discovers Its Revenue Potential

A Media Agency Discovers Its Revenue Potential

Outsourcing Services

- Bank reconciliation

- Accounts receivable maintenence, including billing

- Accounts payable maintenance, including bill pay

- Subsidiary account reconciliation

- General ledger maintenence

- Month-end close support

- Consolidation of financial information

- Customized financial statement reporting

- Documentation of accounting processes and definition of roles

- Budgeting and forecasting analysis

- Buy-side intergation services

- Opening balance sheet support

- Audit support

- Finance Assessments

- Fund Accounting

- IT & Managed Services