Our research finds that manufacturers have enjoyed three strong years of growth, but are now in a pinch. On the one hand, their labor costs as well as other costs like those around holding inventory are up and will continue to rise. And yet the one easy answer — passing those higher costs along to customers via price increases — is less available to them. Customers are less willing to pay more today versus 12 months ago.

In this article, we explore some of the factors contributing to higher labor costs and what manufacturers and distributors are doing to protect their EBITDA. Unless otherwise stated, all data is from our 2024 Manufacturing and Distribution Opportunities Report.

43% of manufacturers and distributors saw significantly higher employee costs

Labor grew more expensive last year and 50% of manufacturers say this was one of their top hurdles to reshoring operations. Employee costs are unlikely to decrease because U.S. living costs continue to rise — rents have quickly outgrown income in several major metros, and national real wage growth was negative for several years and has only just recovered. If it’s any indicator, the UPS and Teamsters Unions negotiated a five-year contract where at the end, UPS drivers will make an alleged $170k per year.

36% of manufacturers and distributors report significant labor shortages

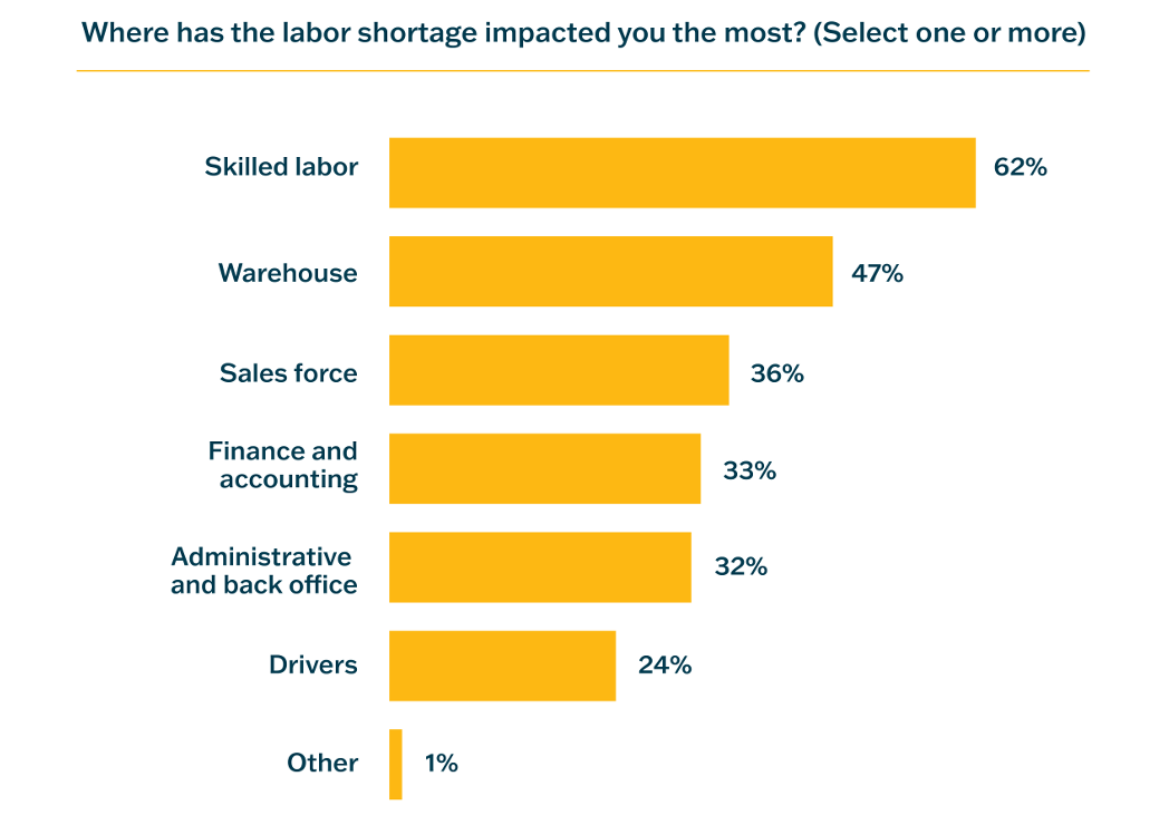

Labor shortages have shown up evenly across all areas of operations. The U.S. Chamber of Commerce says 622,000 manufacturing job openings were yet to be filled as of January 2024, and the Bureau of Labor Statistics projects assemblers and fabricators to have the most unfilled openings through 2032.

This sustained shortage is helping to drive up wages, benefits packages, and overall employment costs.

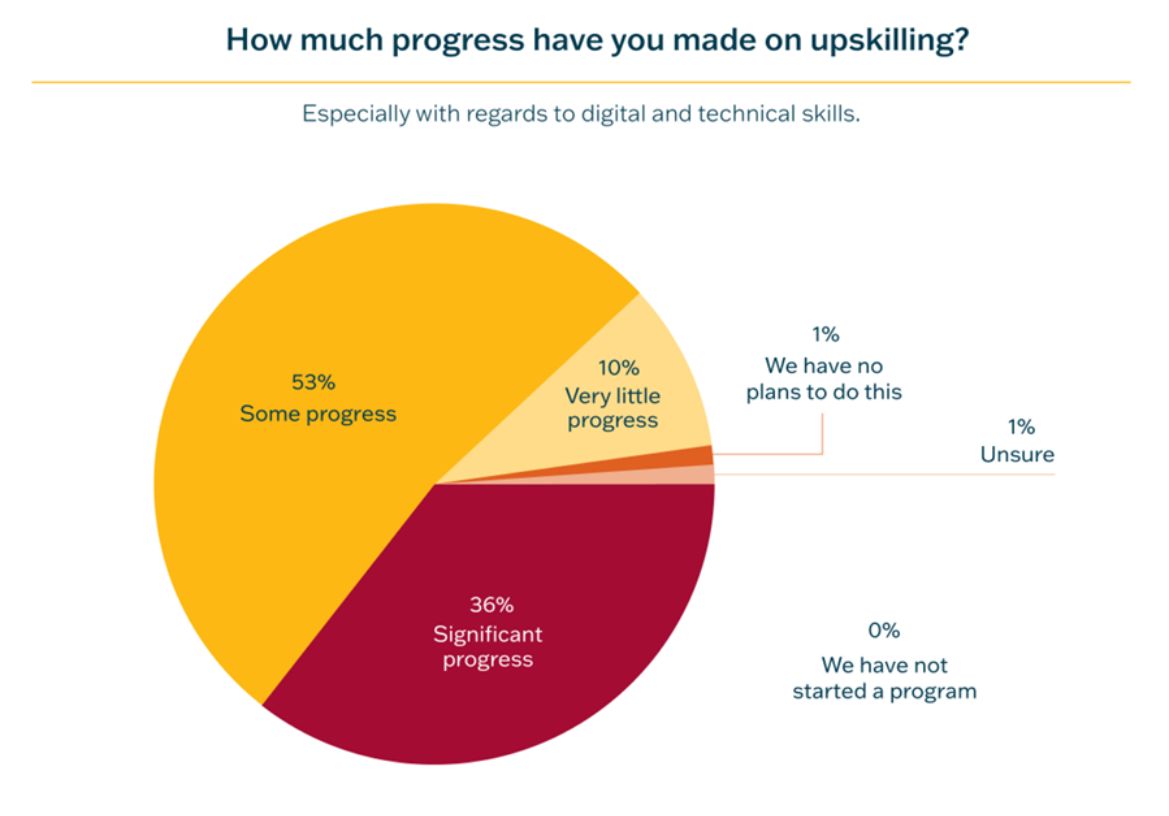

Just 36% have made progress on upskilling

This figure puts manufacturers and distributors only somewhat behind other industries (38%). Part of the reason may be that upskilled manufacturing workers are somewhat more difficult to retain. From the warehouse to skilled trades, it’s an employee’s market, and 42% of manufacturers say retaining newly upskilled workers is a top challenge.

Upskilling programs are expensive in three ways. One, they cost money to develop and enact. Two, they take workers away from their present duties. And three, when they do not work as intended, there’s no payback on the above costs and sometimes higher churn.

As a result, manufacturers are trying three things:

Outskilling as a way to upskill

As labor shortages and costs worsen, we’re seeing many companies outskill — outsourcing the skilled part of a job to experts on contract. Those experts augment and can even teach existing employees. Outskilling can be cheaper and more assured than launching an internal training program — there's no certainty a training program will work or prove its value quickly. Whereas outskilling is a more direct and immediate answer.

This is a large part of why 90% of companies in our survey said they need to look outside their organization to help with advanced technological readiness. When companies invest in outskilling and outsourcing, it also allows them to train their existing workforce and sometimes, transition them to more meaningful roles.

Investing more in getting the employee experience right

You can’t outskill your entire company. Full-time employees are vital, and full-time churn is expensive and you should strive to retain their various talents. It may be 6-12 months before a replacement is productive, and sometimes the knowledge full-time employees take with them is irreplaceable.

If you invest in training programs, invest in programs that make employees more adaptable and ready for even more disruption. There is no reason to believe the present rate of change will slow. Think about the present wave of new skills, but also beyond, to what’s next.

Manufacturing companies are:

- Investing in clearer career paths

- Investing in manager training (just 18% receive formal training)

- Reevaluating requirements (e.g. certifications, degrees)

- Diversifying their hiring pipeline (by revisiting language, finding new sources)

- Reevaluating and updating benefits

Building up more internal muscle for business process outsourcing (BPO)

The build-versus-buy equation is tipping toward “rent.” The key ingredient to outsourcing work is understanding how it is done, and few companies have their work documented well enough to productively incorporate outsiders. Outside consultants can help you with this and prepare your teams.

BPO can offer a strategic way to:

- Control costs

- Accelerate timelines

- Standardize processes

- Create consistency

- Minimize errors

- Increase transparency

Enlist an expert to audit your BPO readiness. They can evaluate and advise on:

- Quality of your documented procedures

- Systems you are using

- Maturity of your financial reporting

- Level of current support from accounting

More opportunities

For more, and to understand the financial and tax advantages you can gain when you get back to finance basics in 2024, read our 2024 Manufacturing and Distribution Opportunities Report.

Want to learn more?