Real estate risk is high, and investors know it. Many are shaken. However, you can manage that risk on two fronts — by changing your capital stack to reduce your reliance on equity, and by using those capital stack improvements to tell a better (and still true) story to investors and limited partners.

In our latest report, we explore how capital stacks are changing, and the advantages new debt structures can offer. Below is an excerpt. For the full analysis and advice, download your copy.

Firms are shifting from equity toward debt

Firms are feeling the effects of interest rates, inflation, and the cost of capital. And the market continues to feel the force of trends like working from home, global instability, and new U.S. tax regulations. It has created a real estate environment that’s far less predictable than in the past. Plans and assumptions are less solid, more subject to change.

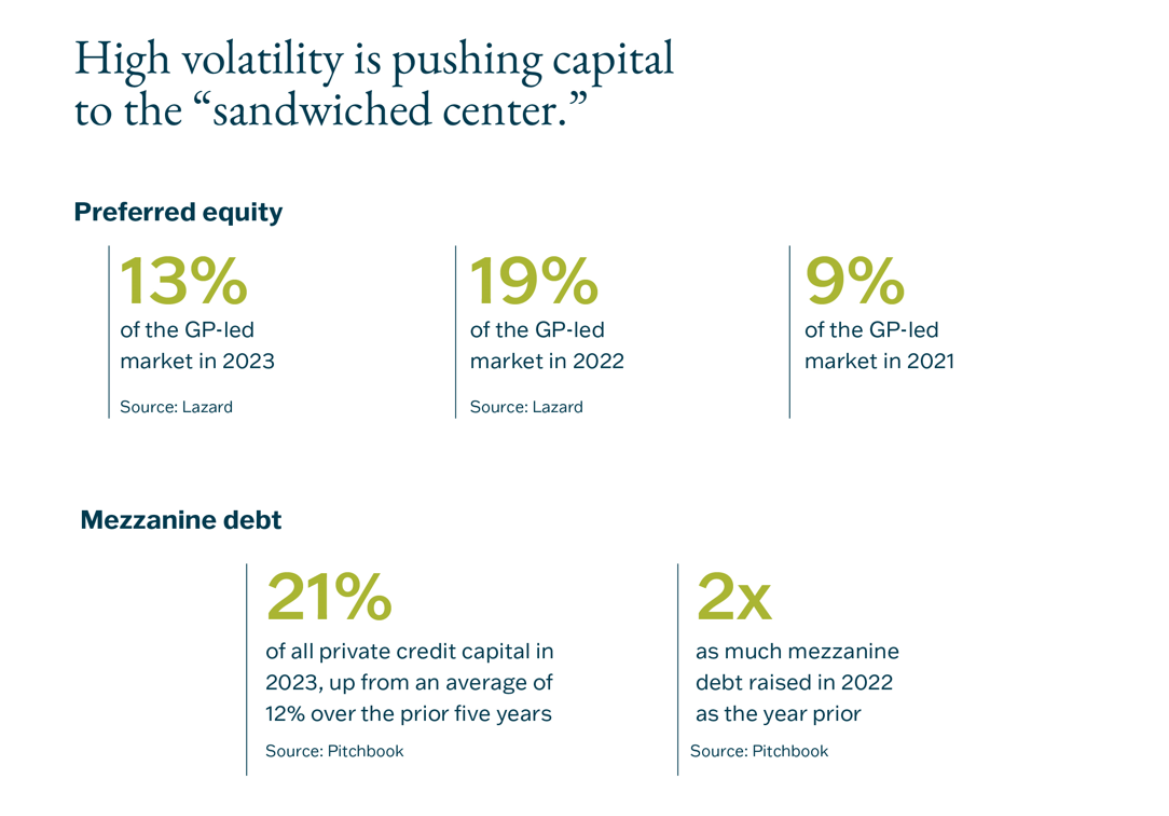

In this environment, we are seeing real estate firms move away from equity toward debt. Specifically, to preferred equity and mezzanine debt or “bridge loans.”

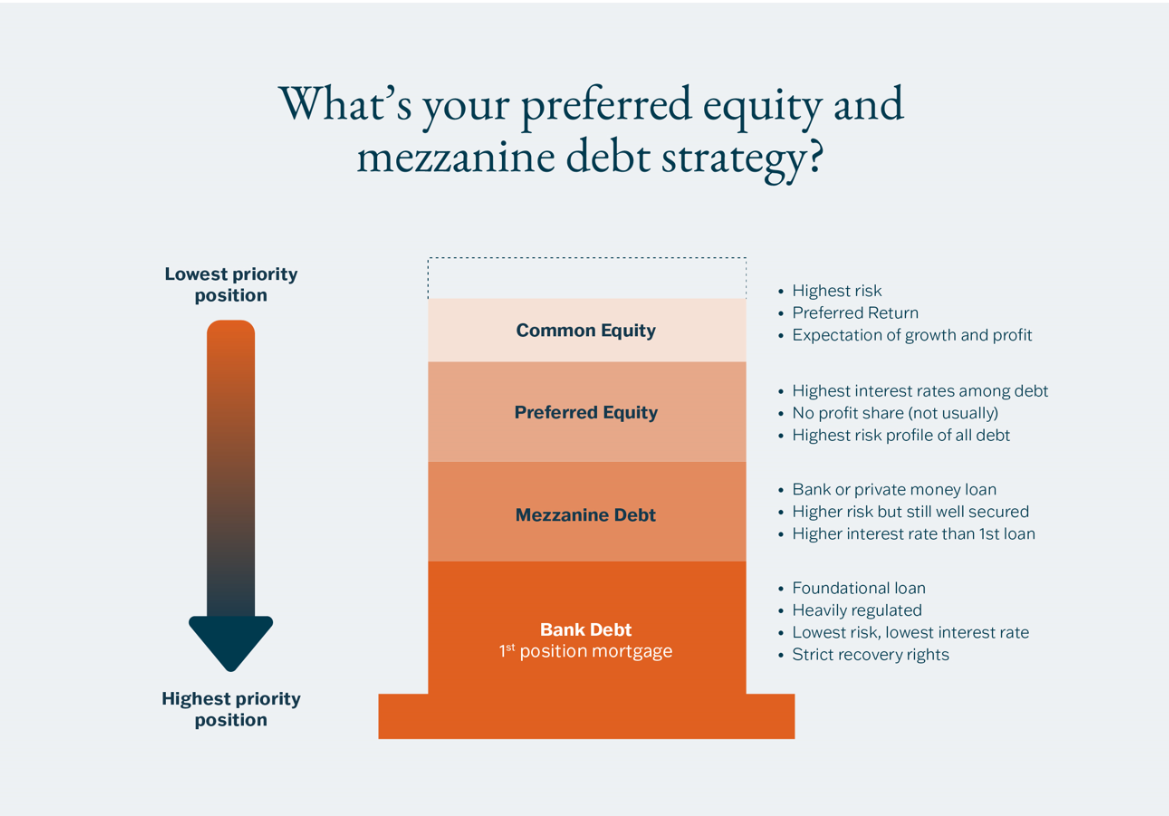

- Preferred equity functions as subordinate debt, where the equity holder receives a fixed rate of return without a share in the profits, but also holds a proportional stake in the entity.

- Mezzanine debt is a secondary loan similar to a second mortgage, where the debt issuer does not own a stake in the entity, but can, upon certain conditions, convert the debt into equity.

Both vehicles offer new opportunities for otherwise great businesses to invest in growth when they don’t have solid cash flow. For investors, preferred equity and bridge loans can effectively reshuffle the risk and make previously unpalatable deals attractive. It means they need not be fully exposed on equity — they could hold preferred debt and earn their interest rate without the risk.

We are also noticing this shift make real estate more attractive to investors generally, and draw new lenders into the market.

These tools allow investors to get greater leverage from their portfolio.

“Borrower companies have used preferred equity to raise capital without adding cash-pay interest,” writes Pitchbook. “The tool can also bring down leverage to meet loan covenant requirements. In return, preferred equity investors, who are often the private credit lenders, unlock attractive yields and hone the risk profile of their investments.”

There are also multiple ways to approach these new vehicles. There are two types of preferred equity:

- Participating equity: Offers accrued dividends that pay out over time.

- Converting equity: The investor can choose to exit the investment early, under conditions.

Mezzanine debt can include many different types or rights and characteristics, including:

- Call options

- Rights

- Warrants

- Convertible high-yield bonds (HYBs)

- Bonds or Preferred Stock with warrants

- Convertible preferred stock

- Subordinated notes with paid-in-kind (PIK) interest

These offer greater flexibility in a tight capital market, where 56% of real estate firms say they are “extremely” or “moderately” worried about the cost of capital, according to our latest survey.

Should your firm explore preferred equity or bridge loans?

It all depends on the specifics of your situation. The best recommendation is to have a strong team of finance, accounting, and tax specialists who can model scenarios and advise.

For more on the shifting capital stack, read our latest report, the 2024 Real Estate Opportunities Report.

Related Insights

All InsightsOur specialists are here to help.

Get in touch with a specialist in your industry today.