Poor office performance has the industry in a haze, but when you look at the data, the fog lifts somewhat. For example, 81% of real estate companies in our recent survey of large private companies said they grew net operating income (NOI) last year. It may strike some as surprising, but it tracks the broader economy, where a majority of companies in all industries said they grew both revenue and EBITDA.

Working with real estate firms, we believe now is the moment to make opportunistic moves. Here are a few of the opportunities we see right now. For more, download our latest report.

Reasons for cautious optimism

There is no doubt real estate will see more disruption this year. A reported $929 billion in commercial mortgages will come due, including $206 billion for offices. Though we and the broader market largely expect lenders to work with owners and extend these into 2025.

A few signals are moving in a positive direction for some markets. Take Miami. There, increased commercial rent prices across the board signal just how many businesses and consumers the city has attracted from other major metros over the past few years. Job opportunities there have created demand for housing which makes it an attractive place for multifamily right now. (Yes multifamily vacancies have deteriorated in Miami, but it’s only 4.7%, up from 4% last year.)

Similarly, industrial real estate is doing quite well — prices are up 6% according to MCSI’s commercial prices index, amid an overall 2.2% real estate decline. Much of that is due to a boom in manufacturers reshoring, nearshoring, and growing their operations. Though absorption and vacancies have increased, rent increases are the real number to pay attention to.

This is all to say, within all this variability and depressed nationwide numbers, there are pockets of opportunity. Look into multifamily in sunbelt states and alternative but related asset classes like energy infrastructure, data centers, sports facilities, and live entertainment.

Also consider that new investment vehicles can make unattractive markets work

Working with some of the world’s largest private real estate companies, we can say from our experience companies are still doing deals, and the deciding factor is, increasingly, a question of cleverly using capital. Even though our survey found 56% of real estate companies are “extremely” or “moderately” worried about the cost of capital, leaders are getting creative.

1031 exchanges

Consider 1031 “like kind” exchanges, which are often thought of as a tool for individual homeowners. Over the past three years, their use spiked among institutional investors. “This is a major behavior change for private equity firms especially,” says Gary Zhang, Partner at Citrin Cooperman. “Traditionally, their goal was to buy, hold, and sell property so they could return profits. But we saw a major surge in them exploring much more complicated 1031s and rolling proceeds over.”

This is anecdotal, but Citrin Cooperman saw requests for help with 1031 exchanges peak in 2022, then fall by two-thirds. That said, they remain more popular than they were prior to the pandemic, when they accounted for 10% to 20% of deals. That decline is due to interest rate pressure, but they’re still more common than before, and an underused tool, we think.

Real estate investment trusts (REITs)

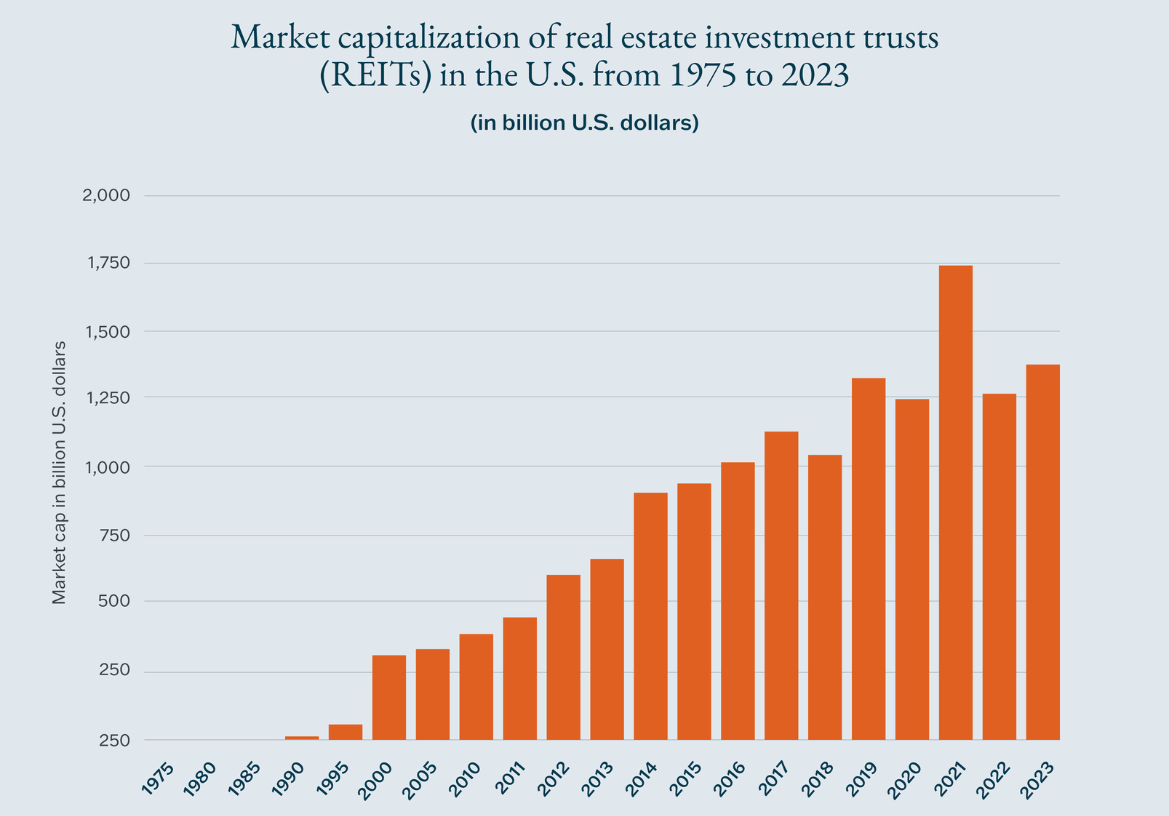

REITs also rose over the past five years, and after a spike in 2021 followed by a decline, they’re on the rise again. They provide many advantages, including the ability to defer taxes.

Also consider the capital lens — a reformulated capital stack can unlock opportunity

Capital stacks are increasingly shifting to the “sandwiched center,” from equity to preferred equity and mezzanine debt.

- Preferred equity: Equity that functions as subordinate debt. The equity holder receives a fixed return without a share in the profits, and also holds a proportional stake in the entity.

- Mezzanine debt: A secondary loan, similar to a second mortgage, where the building serves as collateral and the debt issuer does not own a stake in the entity. It is serviced after the senior debt but offers a higher rate of return.

Preferred equity and mezzanine debt can effectively reshuffle the risk and make previously unpalatable deals attractive. They allow investors more flexibility, and may attract new sources of capital into the market.

Should you switch yours? Possibly. Many companies are more comfortable with that sandwich in the capital stack rather than the risk of being solely on the equity side. Things are not like the old days when you had a predictable chance of hitting your numbers.

Where are the opportunities for you?

Download our latest report, The 2024 Real Estate Opportunities Report, for more actions your firm should consider as the industry exits survival mode.

Related Insights

All InsightsOur specialists are here to help.

Get in touch with a specialist in your industry today.