The market may look great in terms of committed capital but much remains dysfunctional. The story varies widely based on sector and by type of fund — things look very different to emerging managers and independent sponsors. The historically low levels of deals, despite 1.5x as much dry powder as six years ago, also suggests something will have to give.

To understand what we can expect from 2025, our team looked back. We studied how 1,000 private companies performed over the past year and surveyed both emerging managers and independent sponsors. We then supplemented this with PitchBook data and produced our 2024 Private Equity Opportunities Report, of which this is just an excerpt.

We present the short version below in this article. It is about how both funds and portfolio companies are overdue a technological audit, and some well-applied modernization. Technology will play an outsized role in exits next year.

A “lost year” for many, but not all

Players throughout the private equity and venture capital market are feeling pressure to act. All the waiting is starting to affect their track records, and limited partners are pushing for exits because they badly want greater liquidity. It is an industry awaiting a sign.

One of the most persistent barriers to exitsis a perceived “pricing gap.” Buyers feel valuations are inflated, while sellers are committed to their original targets.

This pressure is giving managers reason to rethink their fund thesis. They are meeting more frequently with more limited partners to understand what they’re looking for, be it technology, employees, governance priorities, or the service provider teams around them.

Despite all of this, the great majority of managers remain committed and expect things to return as they were before. According to our survey, 90% of emerging managers say they will be raising more funds soon. A sense of pessimism does not preclude the fact that opportunities still abound.

Raising capital remains difficult in this market

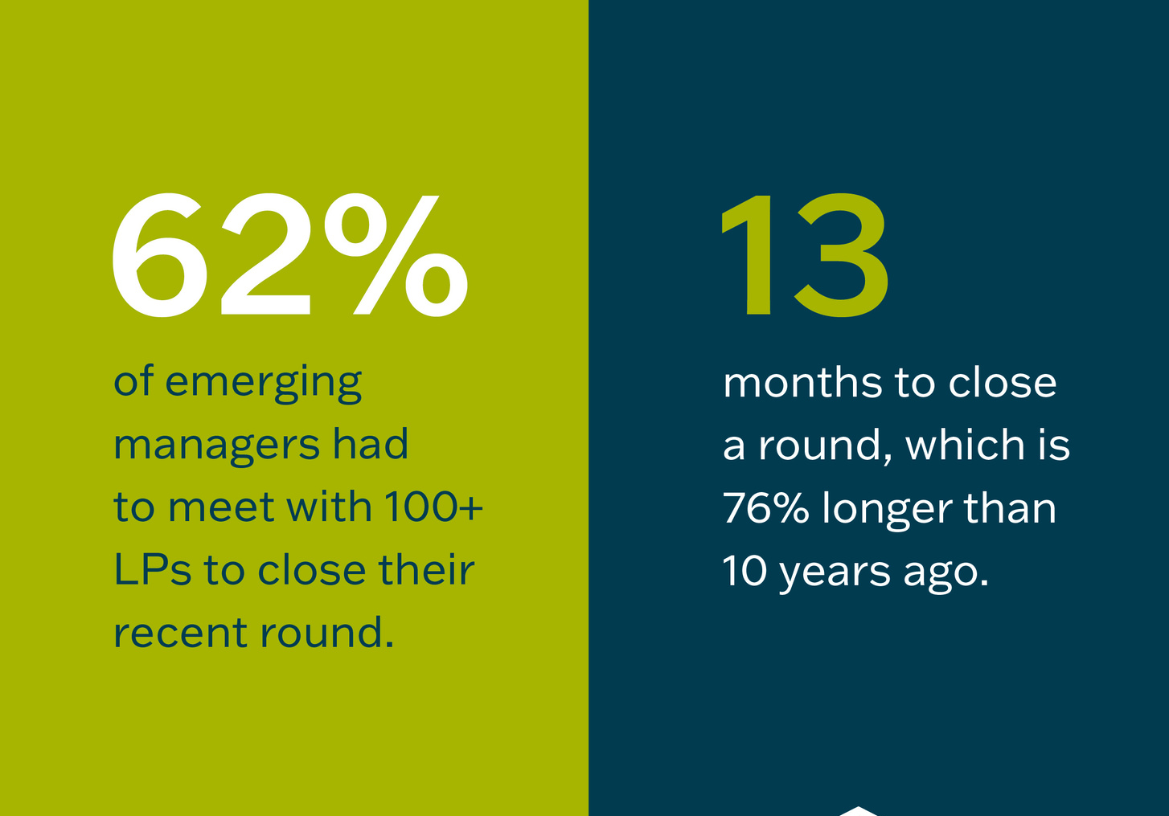

Between inflation and interest rates, the funding environment remains difficult. The median time to close a round has nearly doubled over the past decade, from 7.4 months to 13 months according to PitchBook. Furthermore, sixty-two percent of emerging managers had to meet with more than 100 limited partners to close their recent fund based on our survey results.

Meanwhile, interest rates are finally impacting deals and EBITDA multiples dropped from 9.9x to 9.6x last year reports Capstone. If we exclude a small number of large outlier deals, the multiple is just 8x. Independent sponsors are seeing a similar downward trend. Seventy-six percent of independent sponsors told us they’d closed a deal for 6x or less in the past year.

Compliance, cybersecurity, and other costs are rising

Costs are increasing for portfolio companies across the board, and it is no different for funds. “Costs associated with operating a fund have surged due to heightened demands in compliance, information technology (IT), cybersecurity, legal matters, and fund administration,” says Christopher Brown, Partner at Citrin Cooperman.

Meanwhile, software really did take over the world, as evidenced by the now 10-year-old Stackie Awards, where companies outright celebrate having accumulated so many software licenses they make a collage of the logos. Fund managers be warned: Every one of those licenses carries a cost. Part of the disarray stems from the fact the “best of breed” theory to buying software has won, and so many companies have opted to purchase many point-solutions rather than one suite from a large, legacy vendor, leaving little room to negotiate costs with each.

Said another way, all those recurring subscriptions are great — for the companies that are selling them.

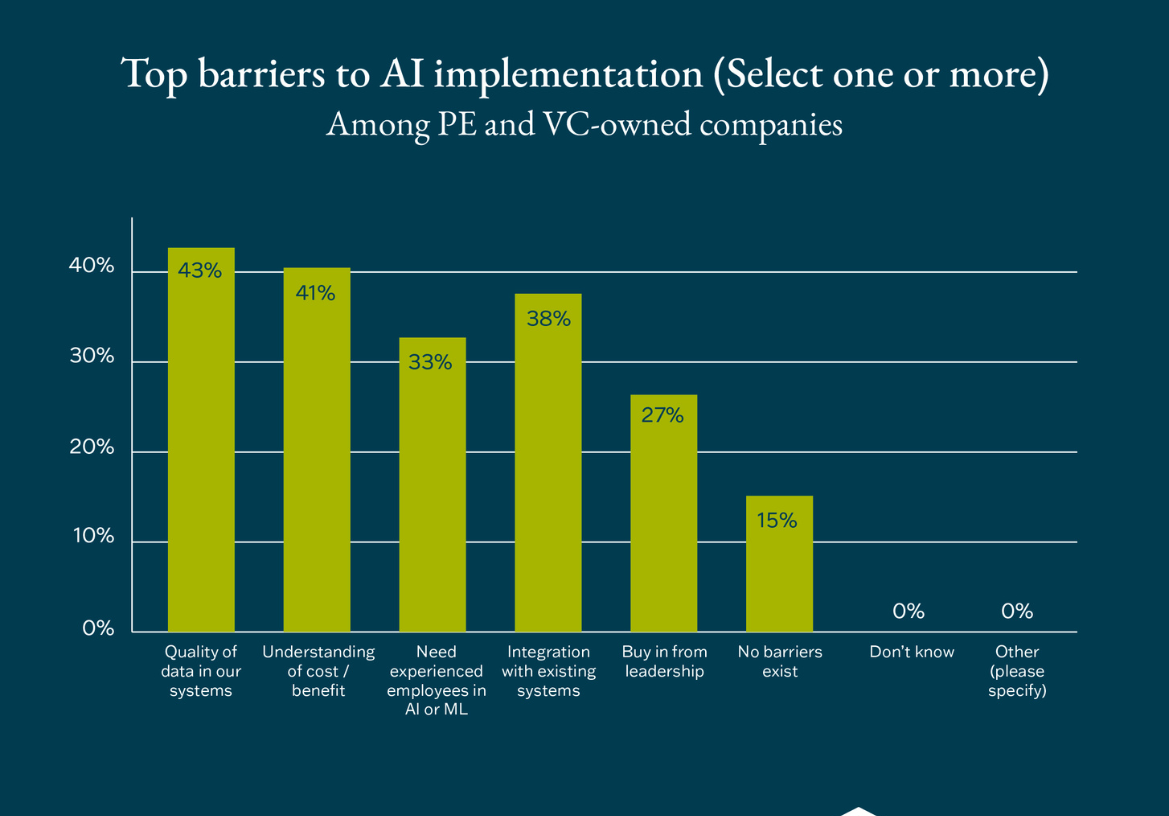

Outdated technology is the greatest barrier to AI adoption

In many cases, portfolio companies are not keeping their technology up-to-date enough to harness new technologies like AI. Forty-three percent of PE or VC-owned companies told us their top barrier to adopting AI was the poor quality of data in their system, and 47% of them had not updated their ERP system in over five years. There is a connection.

Meanwhile, new technology can quickly give a portfolio company an edge. Many funds we work with have recently seen technology-aided exits.

Workforce conditions have improved

A bright spot in this story is that workforce conditions have improved, and it will likely continue to be an employer’s market in 2025. Some 65% of emerging managers told us they had more access to talented operators than they did a year ago. When interest rates began to slow the economy and affect startup burn rates, many more senior managers were on the market than before in recent memory. That has been good for PE/VC firms staffing their portfolios with uncommon talent, especially smaller companies that would struggle to compete.

More talented operators in the market also opens the door to cleverer outsourcing. Many senior individuals have gone “fractional,” offering part-time services. This presents an uncommonly rich opportunity to have operators who have successfully exited multiple times mentor your portfolio’s leadership, without the cost or hassle of recruiting.

Some 30% of PE or VC-owned companies say they will fill a majority of their talent gaps using consultants and 90% of companies generally say they must look outside their walls for at least 25% of advanced technical talent.

What do managers expect from next year?

We don’t expect it to become easier to raise capital next year, and the rising technology and cybersecurity costs are reverse. Our advice for next year is the same as this: Pursue opportunities to improve the operational service providers surrounding your portfolio, and find opportunities to strategically outsource functions like finance and accounting.

Despite the potentially grim outlook of more of the same, there is a high note. Optimism is still high. Some 47% of CEOs hold a very or somewhat positive outlook on the U.S. economy and expect good things from next year. In addition, board members are 19% more optimistic about the next 12 months than they were one year ago.

There is every reason for fund managers to see plentiful opportunities—not in spite of this market, but because of it.

To learn more or discuss these topics, please contact Alex Reyes at areyes@citrincooperman.com.

Related Insights

All InsightsOur specialists are here to help.

Get in touch with a specialist in your industry today.