It’s not a roaring return, but as advisors to some of the world’s largest and most active real estate companies, we feel it’s time for the firms we work with to make opportunistic moves.

Economy-wide, optimism is up — our recent survey found 68% of leaders tell us they believe the economy will only improve over the next 12 months. (Which does not rule out a recession.) Across industries, revenue and EBITDA are up, and real estate is integral to — and a beneficiary of — that equation.

Of course, any opportunity is highly dependent upon sector, asset class, and geography. But here are five trends we’re watching, and the data that makes a case for a bleated return. For more on how to take action, read our newest report.

1. Commercial vacancies are volatile with no clear trendline

At first glance, the data seems to suggest that vacancies remain high and absorption low. But when you segment that data from sources like CBRE, Colliers, and Marcus & Millichap as we have, it shines a spotlight on some markets like Miami, which have attracted businesses and consumers from other markets over the past few years, and created a multifamily boom that bucks the broader trend.

Miami’s population grew 1.31% between mid 2022 and mid 2023 and companies from Amazon to Apple, Uber, Microsoft, and JP Morgan Chase are all increasing their office footprints.

Somewhat offsetting these mixed signals is the fact that rents are up in many markets, which suggests increased strength. And where signals are deteriorating, like in LA, the overall market remains firm. LA is still the largest industrial market in the U.S. and its nearby ports are full of containers. Combined with the fact that the U.S. Baltic Exchange Dry Index is up, which signals ships are full of materials for manufacture, there is reason for optimism.

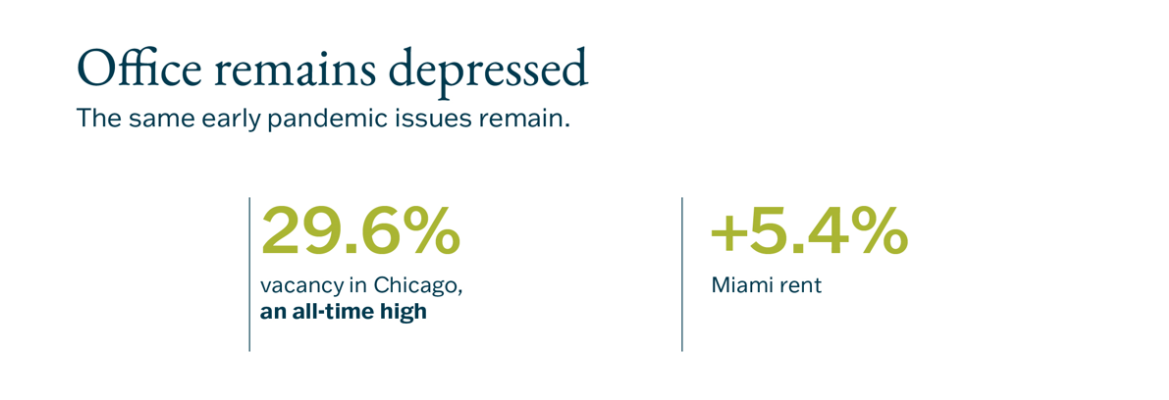

2. Offices show little sign of improvement

People are working from home at the same level (53%) since the 2022 peak, whereas just 21% of jobs are fully onsite (of jobs where remote and hybrid are possible). Office asking prices have continued to decline modestly. Nationwide office vacancies rose to 19.6% in the final quarter of 2023.

Declining office values have complicated the debt markets. In 2024, $206 billion of office real estate loans will mature, though the market widely expects they’ll be extended to 2025 and beyond. Banks are advising owners to optimize for liquidity. All this uncertainty has thrown market value into question and delayed deals. But now, transactions are occurring, albeit at severe discounts for sellers and lenders.

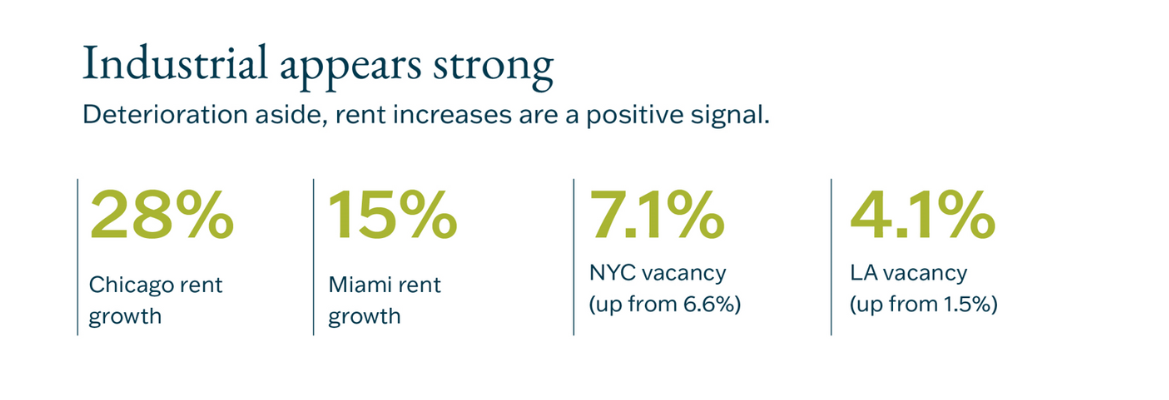

3. Industrial continues to outperform

Over the past year, industrial real estate prices are up 6% according to MCSI’s commercial prices index, amid an overall 2.2% decline (major metros declined far more than non-major metros). The commercial sector nearly broke even (0.7%), and office spaces — specifically, office spaces in commercial city centers — have continued to fall.

An insight: Industrial real estate may be benefiting from the growing success of manufacturers and distributors. Our recent survey of these businesses (the leaseholders) reveals that they are nearshoring and diversifying. Ninety percent said their supply chains had stabilized in 2023.

4. Multifamily and residential look promising

Multifamily inventory is up 3.4% since 2020, and expenses have risen by 6.5% year-over-year, primarily driven by a 36% increase in insurance costs. However, the outlook seems positive: renting has become less expensive relative to homeownership by some measures, and that’s despite the fact that rents have increased by 30.4% since 2019.

With these statistics and delayed deliveries for 2025 and beyond, we are likely to see continued rising demand for multifamily, with less supply. We believe this will continue to fuel the market.

5. Cost of capital remains a top concern

Some 56% of real estate companies are “extremely” or “moderately” concerned about the cost of capital. And while we may see relief soon — The Federal Reserve maintained rate hikes in 2022 and 2023 and has continued to defer any reductions — there are still many things companies can do.

Notably, they can explore alternative financing for projects. In our 2024 Real Estate Opportunities Report, we explain how this is driving investors to use preferred equity and mezzanine debt, and explore C-PACE and other loans.

With the right financial team at your side, the real estate market may look very different.

How can you capitalize on these trends?

Download our latest report, The 2024 Real Estate Opportunities Report, for more ways your firm can advance as the industry exits survival mode.

Related Insights

All InsightsOur specialists are here to help.

Get in touch with a specialist in your industry today.