On August 16, 2022, the Inflation Reduction Act of 2022 (IRA or the Act) was signed into law. The legislation includes various provisions aimed to further incentivize domestic energy production and manufacturing, as well as reduce carbon emissions. Included in the Act are provisions related to the long-standing tax incentives for investments in energy efficient projects contained in Internal Revenue Code (IRC) Sections §179D and §45L.

The Act provides an incentive for architects, engineers, and designers of certain buildings owned or rented by tax-exempt organizations by allocating the §179D tax benefits of projects they are affiliated with from the tax-exempt entity to the service provider. Additionally, under the current regulations, the deduction must be reduced by all past §179D deductions. The Act reduces this to a three-year lookback period for property owners and four years for building architects, engineers, and designers.

One of the more important changes contained in the Act related to §45L permits the credit to be available to residential real estate projects regardless of the amount of stories. Prior to the Act, only projects less than three stories were permitted to take advantage of the credit. This change means that multifamily projects that are four or more stories high may now qualify for both §179D tax deductions and §45L tax credits.

The Act also includes amplified benefits under §179D for projects which meet certain wage requirements. However, at this time, regulations and guidance related to that provision have not been finalized.

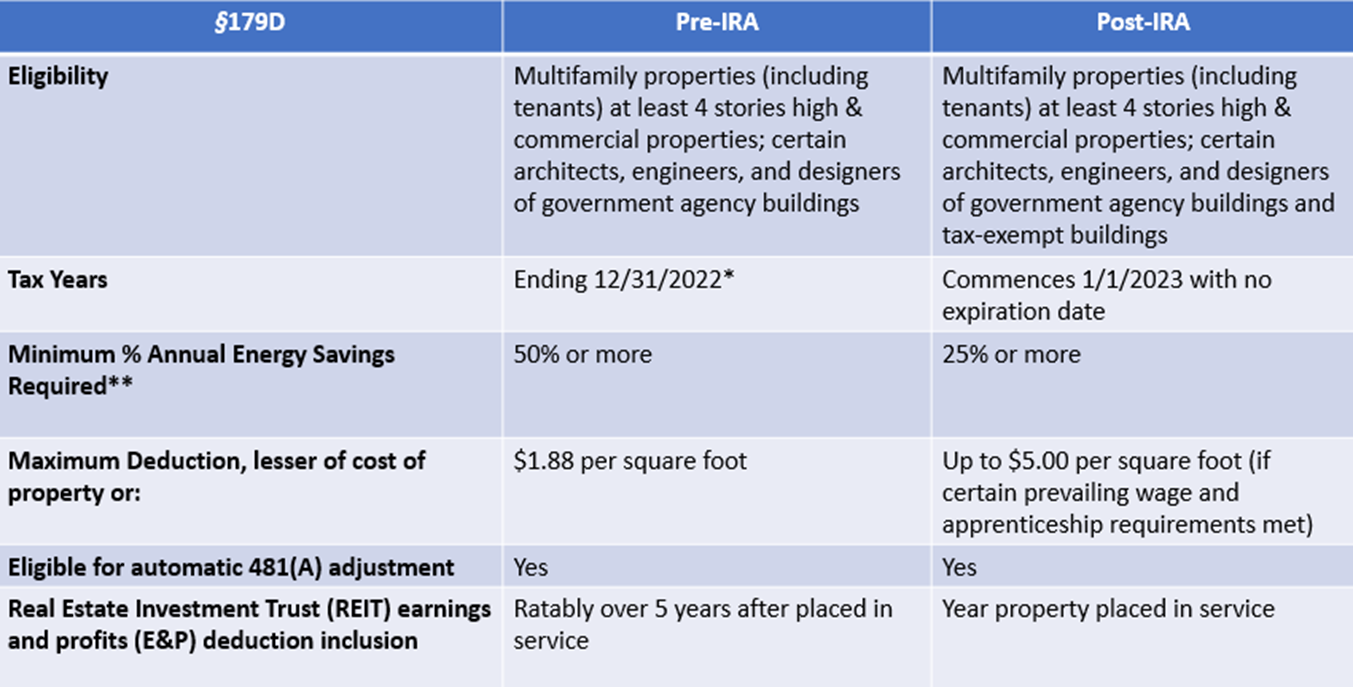

The charts below contain a comparison of some of the general pre and post Act provisions, which should be considered in totality based on the facts and circumstances.

IRC §179D Energy Efficient Building Tax Deduction

* The Consolidation Appropriations Act signed into law on March 15, 2022, made the §179D deduction a permanent program. Post-IRA, the §179D standards in place Pre-IRA now end on 12/31/2022.

** Savings refer to the reduction in the energy and power costs of the combined energy for the interior lighting, HVAC, hot water systems and envelope as compared to a reference building that meets the minimum requirements of ASHRAE Standard 90.1-2007

IRC §45L Tax Credit for Energy Efficient Homes

*** Credit dependent on energy efficiency requirements that the home satisfies

Citrin Cooperman can model out the available tax savings and benefits for real estate investments that qualify for §179D and/or §45L. Contact Blake Boshnack at bboshnack@citrincooperman.com, Kevin Burns at kburns@citrincooperman.com, or Citrin Cooperman’s Real Estate Practice to learn more.

Related Insights

All InsightsOur specialists are here to help.

Get in touch with a specialist in your industry today.