Billing is a perpetual challenge in the legal profession. Between getting hours submitted on time, invoicing clients according to specialized formats, and ensuring those clients pay in a timely manner, what should be simple ends up eating time and administrative hours. But it does not have to be this way — with the right accounting support in place, law firms should be able to rest easy knowing that billing, along with other important finance functions, is taken care of.

However, finding the right support can be difficult. As the finance and accounting talent shortage drags on, it is harder than ever to find in-house accountants, much less finance talent with experience in the legal profession. It is no wonder that so many law firms are now turning to external support in the form of outsourcing as a way to access the specialized talent they need, without engaging in a long (and often fruitless) talent hunt.

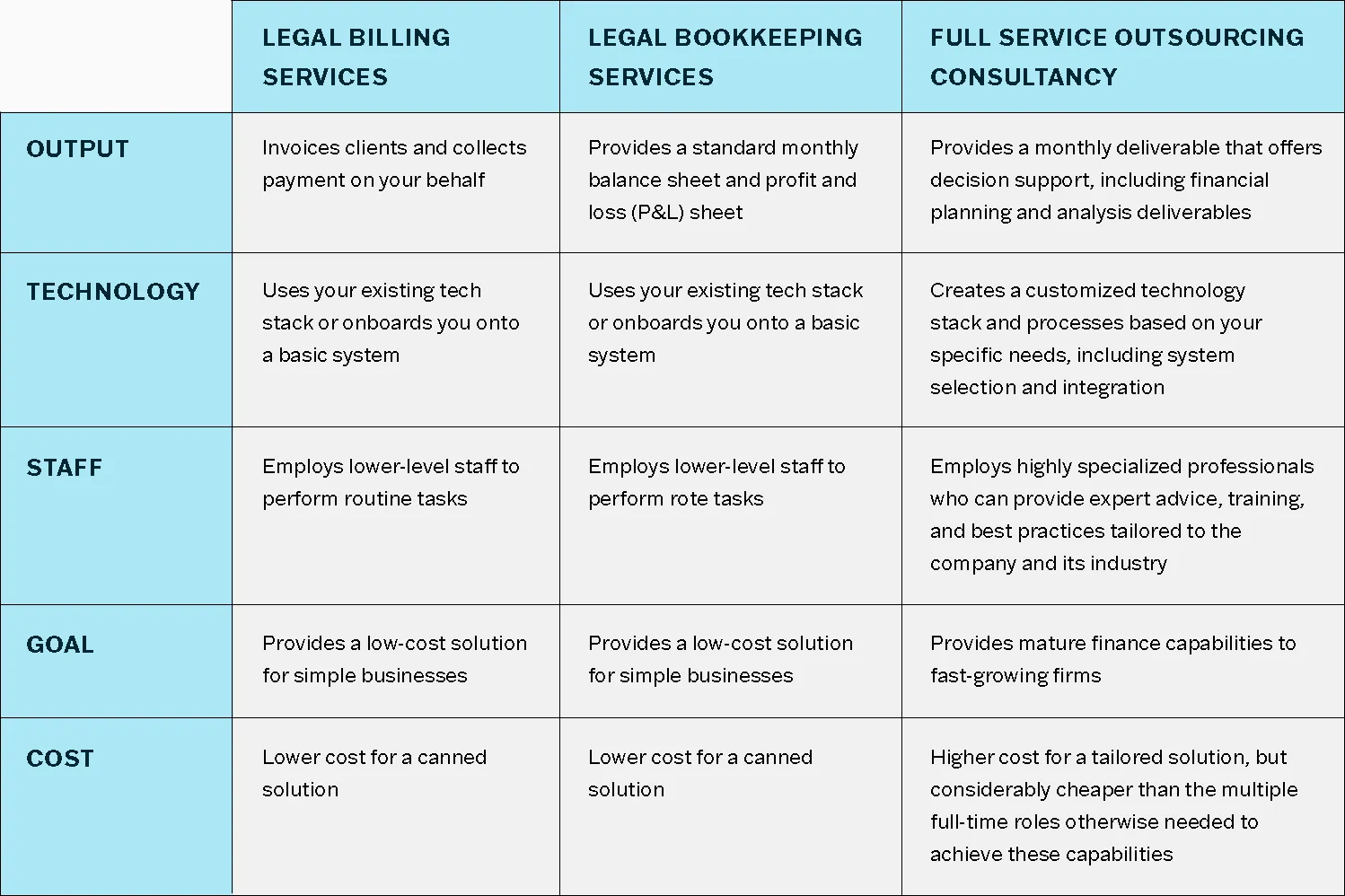

That said, not all finance outsourcing is created equal. It is critical to understand exactly what your needs are and what your outsourcing partner can and cannot provide you. In this article, we will compare three popular options to help you determine what kind of outsourced finance support is right for your law firm.

Option 1: Legal billing services

In recent years, specialized legal billing (or e-billing) services have proliferated, promising to eliminate the pain of late payments and make billing a simple, streamlined process. These firms understand the nuances of billing in the legal profession and can follow LEDES formats, making them more equipped to collect payments than accounting professionals with no legal background.

That said, these kinds of services are limited in the support they can offer. While they can take care of billing, their expertise does not stretch beyond that. Law firms considering this option will still need support in terms of bookkeeping and tax compliance — and choosing to rely solely on legal billing services may leave other financial problems to fester. Ultimately, this can be a cost-effective option for firms that just need help taking the recurring task of billing off their plates, but it should not be treated as a replacement for the finance function.

Option 2: Legal bookkeeping services

Legal bookkeeping services provide basic accounting services. They are able to perform simple accounting tasks like balancing your firm’s books, providing a standard balance sheet, and creating profit & loss (P&L) reports. Some bookkeeping services may also be able to provide help with tax compliance and partner equity tracking, but this varies, so it is important to understand the exact scope of what your provider offers.

To keep their services low-cost, legal bookkeeping firms standardize their services and technology platforms and try to keep those systems and processes consistent across their client portfolio. This may leave some critical gaps. Your firm is unlikely to get any kind of value-added financial reporting that would help you make better decisions for the business. Additionally, if there is any level of complexity, such as multi-state tax reporting, a bookkeeping firm is unlikely to be able to support it. At the end of the day, you may still need outside support to complete higher-order financial tasks.

While choosing this solution will give you more insight into your firm’s financials than you would have if you just opted for a legal billing solution, you still miss out on the in-depth reporting that would help your firm thrive.

Option 3: Full-service outsourcing

Full-service outsourcing is the top tier of outsourced finance models. A full-service outsourcing partner will work with you to create an approach that’s tailored to your firm’s needs. They can work with you to achieve more insightful financial reporting that enables you to make better decisions for your business, keep partners informed about their equity, and stay on top of tax compliance.

A full-service outsourcing partner will focus on building better processes, selecting and integrating the right technology, and either upskilling existing staff or bringing on fractional specialists to help your financial decision-making. Overall, they are invested in your long-term success as a firm.

This greater customization and higher level of expertise comes at a higher price point. However, the benefits more than outweigh the costs. For the price of one finance person’s annual salary, you can get access to a whole suite of fractional specialists who can provide a range of different expertise — for instance, instead of one staff accountant, you can get access to a controller, CFO, and other specialists, such as tax, IT, valuation, and M&A on an as-needed basis. Ultimately, this makes your firm’s dollar go further and also saves the additional costs of employment benefits and taxes.

Outsourcing finance should feel easy

Getting the finance support your law firm needs can feel like a struggle — but it does not have to be. Today, there are a myriad of outsourcing solutions available depending on your firm’s needs. Citrin Cooperman specializes in building out custom, full-service outsourcing solutions to help your firm thrive.

Reach out to Melissa Davis mdavis@citrincooperman.com or Mike Zyborowicz mzyborowicz@citrincooperman.com to discover how Citrin Cooperman’s Business Process Outsourcing and dedicated Law Firms Industry Practice can help improve your firm’s finance and accounting functions.

Related Insights

All InsightsOur specialists are here to help.

Get in touch with a specialist in your industry today.