Citrin Cooperman recently ran two surveys to 400+ private companies and found that 94% of manufacturers and distributors saw their revenue grow over the last year, many for a third year in a row. That’s great news, and by all signs, they expect this to continue. Many are investing in new sites and equipment.

Yet many indicators also suggest that it’s becoming more difficult to protect their EBITDA and margins. Costs are rising in a number of areas, the specter of a recession still lingers, and capital is growing more expensive.

In this article, we explore how manufacturers and distributors are reacting to safeguard their EBITDA — many of them, by getting more creative about how they pass along increased costs to customers. Unless otherwise stated, all data is from our 2024 Manufacturing and Distribution Opportunities Report.

First, the cost challenges manufacturers face

Inflation is now the #1 challenge, ahead of supply chain

Inflation has overtaken supply chain as their primary challenge according to 41% of respondents across all industries. Over 81% of manufacturing and business leaders say inflation has altered their business spending habits and they expect consumer spending to slow in 2024.

Inventory costs are rising

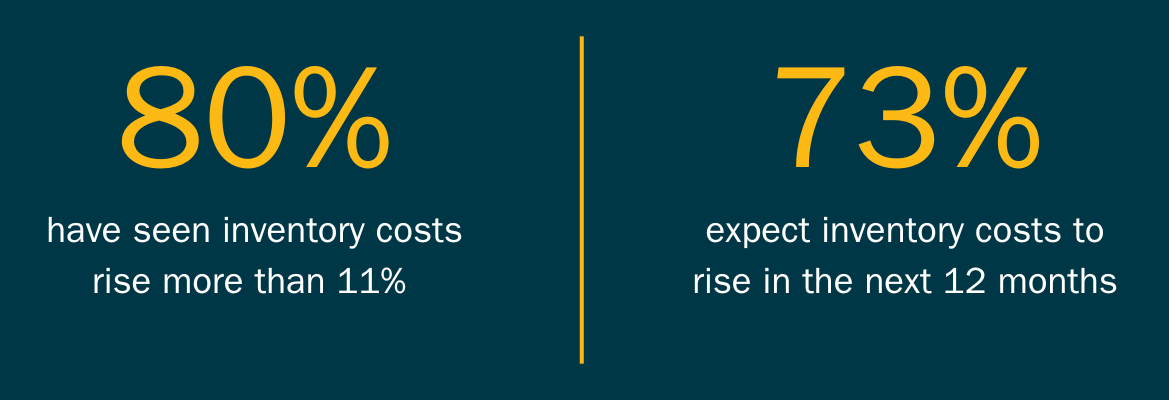

Last year, 80% of manufacturers saw inventory costs increase more than 11%, and 73% expect inventory costs to increase over the next 12 months. In addition to increased costs of product, the costs of holding inventory, including interest on working capital used to pay vendors due to slower turns, are further driving down profitability. Sixty-two percent say they have seen an increase in the cost to carry inventory.

Cost of capital is the #3 biggest challenge

What’s astounding about the positive revenue story last year is that EBITDA continued to grow despite many numbers like inflation, inventory costs, and capital costs moving in the wrong direction. But now, the costs of capital are beginning to bite — manufacturers feel cost of capital is the biggest challenge facing the economy (25%), ahead of, but of course related to, interest rates (23%).

Perhaps they are extrapolating from personal experience. Forty-six percent of manufacturers say the cost of capital is a major impediment to reshoring. And that rising cost of inventory and carrying increases the capital needed to run.

The economy may be softening up

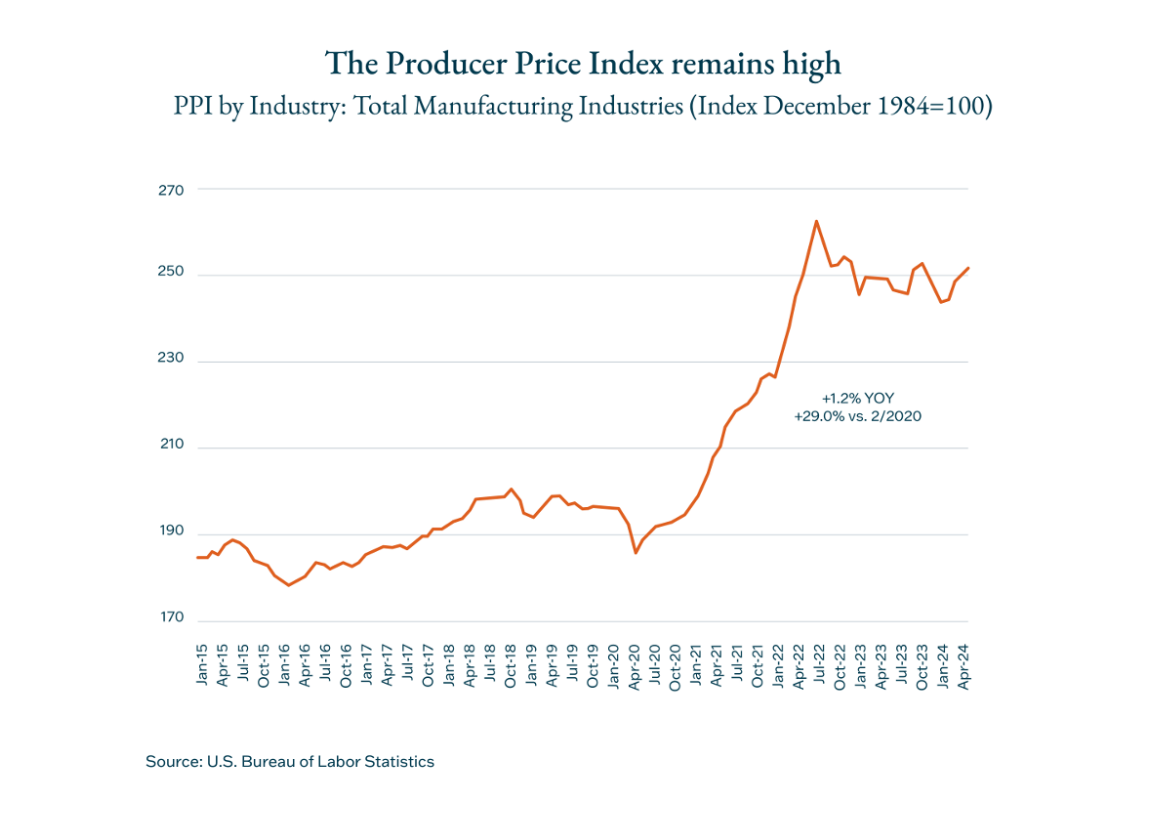

Economy-wide, the producer price index (PPI), which is a measure of wholesale inflation, remains at a historic high (up 1.2%), but appears to be “softening,” according to Dr. Anirban Basu of the Sage Policy Group. Meanwhile, the Consumer Price Index (CPI) remains “stubbornly high” at 3.4%. These may be a sign interest rates are having their intended effect and the economy weakening.

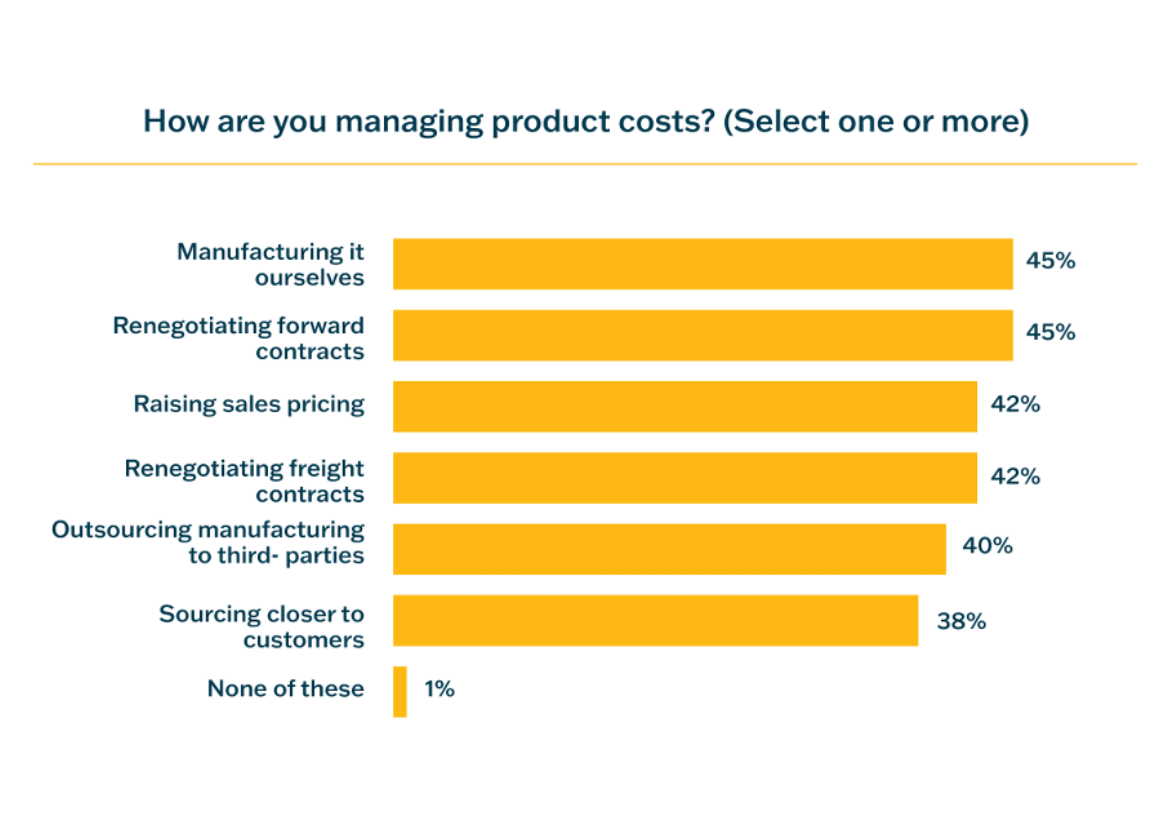

42% of manufacturers are responding by raising prices

The most popular response to rising costs is to insource, or manufacture components themselves, and to renegotiate long-term contracts. But none of these are mutually exclusive and many are also looking for strategic ways to convince customers or even direct consumers to carry part of that burden.

For those passing along prices, how are they doing it?

1. Raising product prices

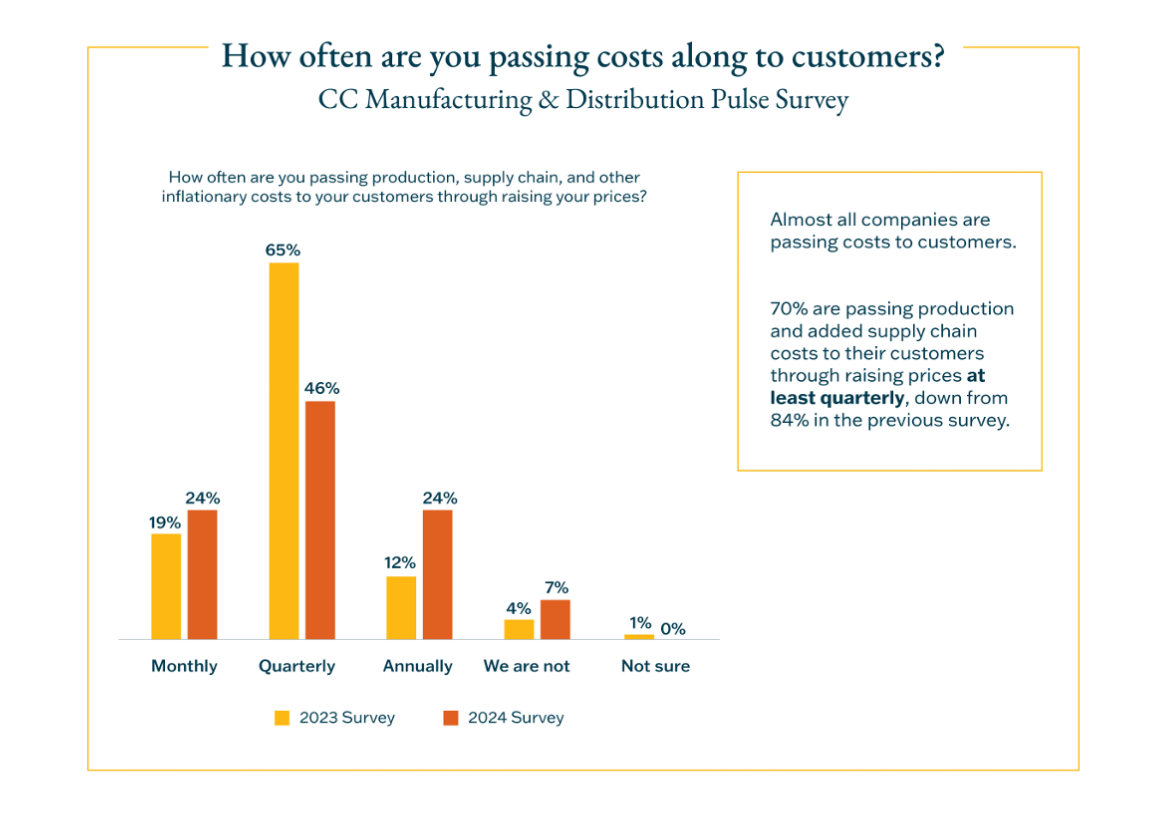

We recommend manufacturers pass those increased costs into projects and product pricing as often as their systems and customers can tolerate. (Building that process is half the challenge.) This year, 26% more companies are passing costs along monthly than last year, and 70% pass along costs at least quarterly.

In discussions with our clients, customers are much less willing to pay higher costs than they were 12 months ago; the narrative has changed and they too are worried about rising costs. This is no doubt part of the reason they are passing along costs less frequently. This year, 70% of manufacturers pass along costs at least quarterly, down from 84% last year.

This is anecdotal, but we find companies with stronger ERP systems, product-level analytics and segmentation, and forecasting are better able to pass along costs more frequently.

2. Applying administrative or service fees

Where it’s not possible to bundle price increases into the base product, manufacturers and distributors are adding prices to costs they previously might have carried, like transport fees, inventory holding fees, and surcharges. Many are also experimenting with supersession pricing to rotate out old inventory.

3. Offsetting those costs by running as operationally lean as possible

We’re seeing our customers more diligently reviewing all their expenses and evaluating how to remain as operationally lean as possible. They’re devoting more resources to identifying and minimizing financial risk — market risk, credit risk, liquidity risk; 15 factors in total — and reevaluating existing supplier contracts.

To keep their EBITDA high, companies must get creative about managing costs

In our experience, manufacturers should pass along costs up to the point of disrupting demand permanently, but no further. And to do it on a product-by-product basis. This all but demands a best-in-class ERP that allows for this product-level segmentation, as well as continuous attention. Of course, the economy will have to remain strong to absorb these price increases. Should it falter, the EBITDA story will change rapidly.

For more insight into trends buffeting the market and ways to keep EBITDA high, read the full report: 2024 Manufacturing and Distribution Opportunities.

Want to learn more?

Related Insights

All InsightsOur specialists are here to help.

Get in touch with a specialist in your industry today.